The Future of Blockchain in Enterprise Applications

Blockchain is evolving from a niche technology powering cryptocurrencies into a foundational layer for modern enterprise solutions. As businesses demand sharper transparency, stronger security, and friction‑free data sharing, distributed ledger technology (DLT) is poised to redefine how organizations exchange value and trust. From supply‑chain provenance and cross‑border payments to tokenized assets and automated compliance, blockchain’s enterprise footprint is set to grow dramatically through 2030.

This guide explores the forces propelling enterprise blockchain forward, the sectors poised for the biggest gains, the hurdles still to clear, and the strategies smart organizations are adopting today to capture tomorrow’s value.

Table of Contents

- Why Blockchain Matters for the Enterprise

- Key Drivers of Enterprise Adoption

- High‑Impact Use Cases in Play Today

- Emerging Trends Shaping the Next Wave

- Challenges & How to Overcome Them

- Building Your Blockchain Roadmap

- Success Stories & Early ROI

- KPIs to Track Business Value

- 2030 Outlook: Where the Market Is Heading

- Conclusion

1. Why Blockchain Matters for the Enterprise

Traditional databases excel at storing and querying information, but they fall short when multiple parties need a single, tamper‑proof source of truth—especially across jurisdictions or competitive boundaries. Blockchain’s core strengths address this gap:

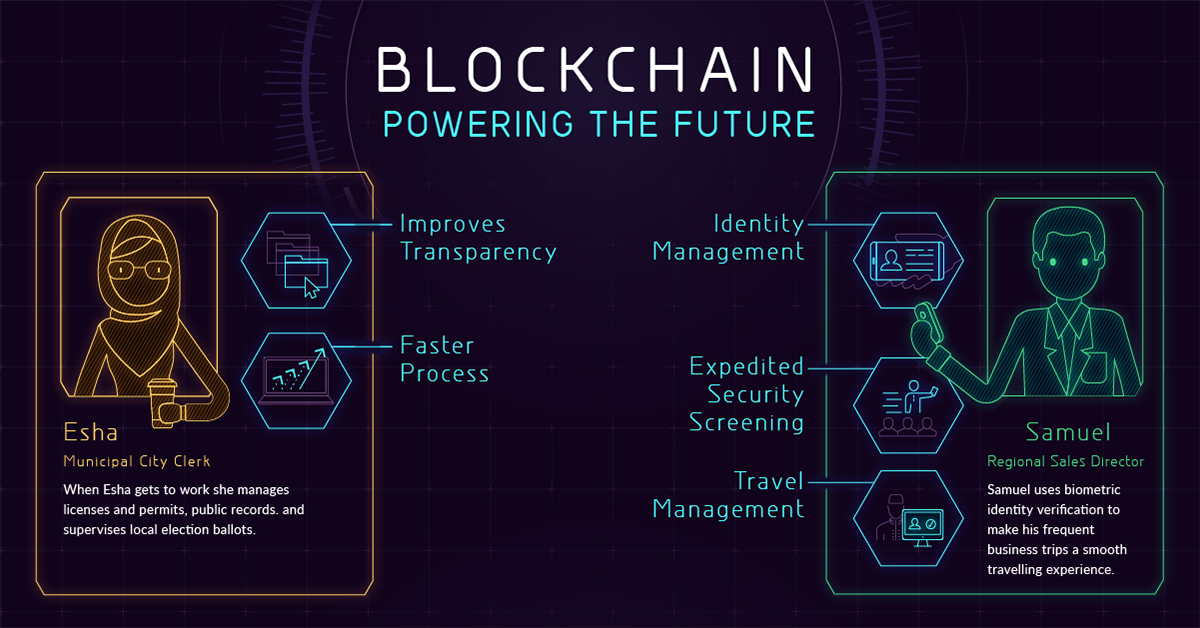

- Immutability: Data blocks are cryptographically linked, making unauthorized changes virtually impossible.

- Decentralized Consensus: Eliminates a single point of failure and reduces counterparty risk.

- Programmable Trust: Smart contracts automate multi‑party workflows, payments, and compliance.

- Transparency & Auditability: Real‑time, cryptographically verifiable records cut reconciliation costs and fraud.

2. Key Drivers of Enterprise Adoption

Regulatory Pressure & Compliance Costs

Inter‑Company Data Silos

- Stricter reporting mandates (e.g., ESG, food safety, anti‑money laundering) elevate the need for real‑time audit trails.

- Supply‑Chain Resilience

- COVID‑19 and geopolitical shocks exposed opaque supply chains. Blockchain brings end‑to‑end traceability.

- Tokenization & New Revenue Models

- Converting physical or intangible assets into digital tokens unlocks fractional ownership and secondary markets.

Inter‑Company Data Silos

- Enterprises lose billions reconciling invoices, trade finance docs, and IP rights. A shared ledger slashes overhead.

- Customer Trust & Brand Differentiation

- – Visible proof of product authenticity or carbon footprint boosts brand credibility.

3. High‑Impact Use Cases in Play Today

3.1 Supply‑Chain Provenance

IBM Food Trust and Walmart track produce from farm to shelf in seconds, cutting recall times and food waste.

3.2 Cross‑Border Payments & Treasury

JPMorgan’s Onyx and Visa’s B2B Connect settle transactions in minutes—reducing fees and eliminating SWIFT delays.

3.3 Trade Finance & Letters of Credit

Kontur and we.trade automate multi‑bank trade finance, trimming paperwork and fraud risk.

3.4 Healthcare Data & Pharmaceuticals

- e‑Health Records: Boston’s MedRec gives patients granular control over health data.

- Drug Traceability: MediLedger helps pharma giants meet DSCSA anti‑counterfeiting rules.

3.5 Energy & Carbon Markets

Grid operators use blockchain‑based renewable‑energy certificates (RECs) to verify green‑energy claims and facilitate peer‑to‑peer energy trading.

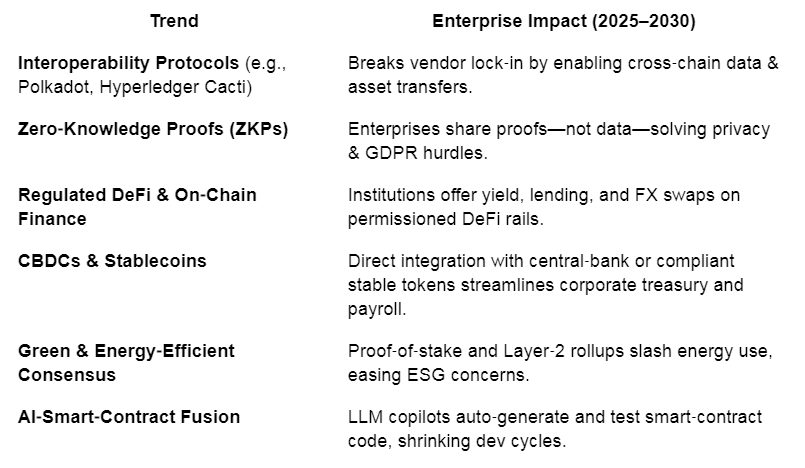

4. Emerging Trends Shaping the Next Wave

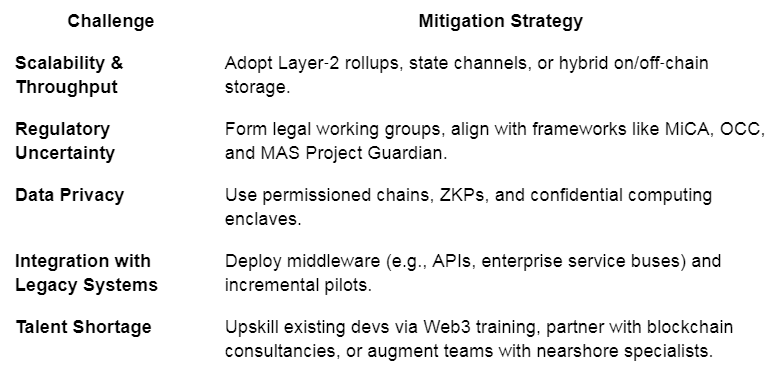

5. Challenges & How to Overcome Them

6. Building Your Blockchain Roadmap

Identify Pain Points

– Target workflows with multi‑party friction, high reconciliation costs, or regulatory exposure.

Select the Right Ledger

– Compare permissioned (Hyperledger Fabric, R3 Corda) vs. public/consortium chains (Ethereum, Avalanche Subnets).

Pilot & Proof of Concept

– Start small (single process, limited user set). Measure time‑to‑market and ROI metrics.

Form or Join a Consortium

– Pool resources and standards with industry peers (e.g., Global Shipping Business Network, Mobility Open Blockchain Initiative).

Design Governance & Tokenomics

– Define node roles, voting rights, fees, and incentive structures early to avoid disputes.

Scale & Integrate

– Gradually onboard additional partners; build APIs into ERP, CRM, and data‑lake platforms.

Monitor, Audit, and Iterate

– Use on‑chain analytics, smart‑contract audits, and security ops to maintain trust.

– Target workflows with multi‑party friction, high reconciliation costs, or regulatory exposure.

Select the Right Ledger

– Compare permissioned (Hyperledger Fabric, R3 Corda) vs. public/consortium chains (Ethereum, Avalanche Subnets).

Pilot & Proof of Concept

– Start small (single process, limited user set). Measure time‑to‑market and ROI metrics.

Form or Join a Consortium

– Pool resources and standards with industry peers (e.g., Global Shipping Business Network, Mobility Open Blockchain Initiative).

Design Governance & Tokenomics

– Define node roles, voting rights, fees, and incentive structures early to avoid disputes.

Scale & Integrate

– Gradually onboard additional partners; build APIs into ERP, CRM, and data‑lake platforms.

Monitor, Audit, and Iterate

– Use on‑chain analytics, smart‑contract audits, and security ops to maintain trust.

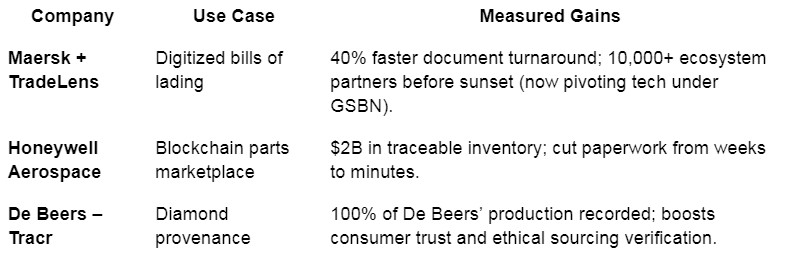

7. Success Stories & Early ROI

8. KPIs to Track Business Value

- Reconciliation Cost Reduction

- Cycle‑Time Improvement (order‑to‑cash, time to settlement)

- Regulatory Compliance Savings

- Error & Fraud Rate Decline

- Partner Onboarding Speed

- Tokenized Asset Volume

- Carbon‑Footprint Transparency Scores

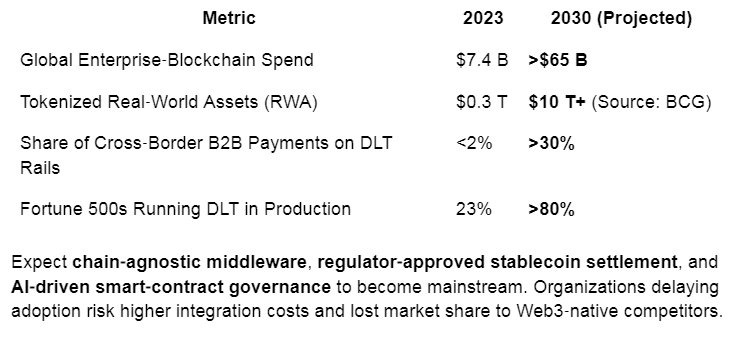

9. 2030 Outlook: Where the Market Is Heading

Conclusion

Blockchain’s journey from crypto buzzword to enterprise backbone is accelerating. Provenance, programmable trust, and tokenization solve pain points traditional IT cannot address at scale. While hurdles remain—scalability, regulation, and change management—the trajectory is clear: by 2030, blockchain will underpin a significant share of global trade, finance, and data exchange.

Enterprises that act now—piloting targeted use cases, joining consortia, and upskilling teams—will be best positioned to capture the next decade’s value. The choice is no longer whether blockchain will transform enterprise operations, but how quickly your organization will harness its potential.

Looking to scale more efficiently? Connect with iDelsoft.com! We specialize in developing software and AI products, while helping startups and U.S. businesses hire top remote technical talent—at 70% less than the cost of a full-time U.S. hire. Schedule a call to learn more!